Saturday, April 22, 2006

Where Do Woodford Property Taxes Go?

County....................5.4%

Township..................8.2

Municipalities............5.2

Schools..................73.9

Fire.........................4.0

Park...........................6 (point-six)

Libraries...................2.7

Multi-Twp...................<.1

The 2003 baseline was approximately $ 42.73 million. (all date from Ill. Dept. of Revenue)

Woodford County PropertyTax Extensions By Type

County............Residential.....Farm....Commercial....Industrial...Rail Roads....Minerals

Woodford..............66%...........21%.............11%................1.7%............<.1%...........0

($ 42,728,191)

Statewide...............61%.............3%.............25%................10%............<.3%........<.1%

Cook County..........53%..........<.1%............34%................14%............<.2%............0

Collar Counties......76%..............1%............16%..................7%............<.1%.........<.1%

Rest of State..........60%............13%...........21%..................6%............<.7%.........<.2%

As you can readily see from the above, Woodford County residential property owners pay a higher share than anywhere, other than the "collar" communities, and of course, our farm owners' percentage is the highest of anywhere. Together, they paid 87% of the total extensions.

Woodford County TransPORT Board Member

Board meeting minutes may be found here.

Illinois EPA's New Fees To Local Communities

Rutherford was forced to file a Freedom of Information Act (FOIA) request last year and appealed the IEPA’s refusal to provide the information on dollar amounts each community was assessed by the Blagojevich administration. Here's why - the inequities are staggering:

City.........Population... Fees..Per Resident.....Fee.......Per Res.

AURORA............142,990....... $35,500.............$0.25..............$36,500..................$0.26

BRIMFIELD.............933.........$5,000..............$5.36................$5,000..................$5.36

CHICAGO.......2,896,016.....$447,500..............$0.15.............$420,000..................$0.15

DEER CREEK..........605.........$5,000..............$8.26................$2,500..................$4.13

EAST PEORIA.....22,638......$37,500...............$1.66..............$32,000..................$1.41

EL PASO.................2,695........$5,000...............$1.86................$5,000..................$1.86

EUREKA.................4,871........$8,000...............$1.64................$9,000...................$1.85

JOLIET................106,221.....$133,500...............$1.26.............$138,500..................$1.30

METAMORA.........2,700.......$18,000..............$6.67...............$15,500..................$5.74

MINONK...............2,168.........$8,000..............$3.69.................$6,000..................$2.77

PEORIA...............112,396......$77,500..............$0.69................$50,000.................$0.44

ROANOKE.............1,994........$5,000..............$2.51..................$2,500..................$1.25

WASHINGTON...10,841...... $28,500.............$2.63................$28,500.................$2.63

A Few More Taxes In Illinois

Illinois Taxes and Woodford County

Sales Taxes

State Sales Tax: 6.25% (1% on qualifying food, prescription & non-prescription drugs, medical appliances). Woodford County Public Safety Tax of 1.0%. Municipal taxes not included.

Gasoline Tax: * 36.2 cents/gallon

Diesel Fuel Tax: 36.6 cents/gallon

Gasohol Tax: 36.2 cents/gallon

Cigarette Tax: 98 cents/pack of 20

Personal Income Taxes

Tax Rate Range: Flat rate of 3% of federal adjusted gross income

Personal Exemptions: Single - $2,000; Married - $4,000; Dependents - $2,000

Standard Deduction: None

Medical/Dental Deduction: None

Federal Income Tax Deduction: None

Property Taxes

Taxes are imposed by local government taxing districts (counties, townships, municipalities, school districts, and special taxing districts. Most property in the state is assessed at 33.33% of its market value, except farmland which is based on its ability to produce income.

There are six different homestead exemptions (Click here for details).

General Homestead Exemption is available annually for owner-occupied residential property. The amount of exemption is the increase in the current year's equalized assessed value (EAV), above the 1977 EAV, upto a maximum of $5,000.

Senior Citizens Assessment Freeze Homestead Exemption allows senior citizens who have a total household income of less than $40,000, and meet certain other qualifications to elect to maintain the equalized assessed value (EAV) of their homes at the base year EAV thereby preventing any increase in that value due to inflation.

Homestead Improvement Exemption is limited to the fair cash value that was added to the homestead property by any new improvement, up to an annual maximum of $75,000. The exemption continues for four years from the date the improvement is completed and occupied.

Senior Citizens Homestead Exemption allows a $3,000 reduction ($3,500 in Cook County) in the EAV of the property that a person 65 years of age or older is obligated to pay taxes on, and owns and occupies, or leases and occupies as a residence. Exemption is limited to the fair cash value that was added to the homestead property by any new improvement, up to an annual maximum of $45,000. The exemption continues for four years from the date the improvement is completed and occupied.

Disabled Veterans' Exemption may be up to $58,000 of the assessed value for certain types of housing owned and used by a disabled veteran or his or her unmarried surviving spouse. The Illinois Department of Veterans' Affairs determines the eligibility for this exemption, which must be reestablished annually.

Senior Citizens Real Estate Tax Deferral Program allows persons age 65 or older, who have a total household income of less than $40,000 and meet certain other qualifications, to defer all or part of their real estate taxes and special assessments. The deferral is similar to a loan against the property's market value and a lien is filed on the property in order to ensure repayment to the deferral. The state pays the property taxes and then recovers the money, plus 6 percent annual interest, when the property is sold or transferred.

Inheritance and Estate Taxes

There is no inheritance tax and only a limited estate tax related to federal estate tax collection.

For further information, visit the Illinois Department of Revenue

Fees And Hidden Taxes

. . . As long as I will be accused of picking on Bloomington, I'll start there.Shortly, we are doing an extensive piece on the cost of "hidden" taxes and fees; state, local, and federal. It will make your hair stand on end. These are the really insidious taxes - the ones you must hunt for to know that you're paying.

Including such things as garbage-collection fees on water bills allows city officials to levy another fee without saying they increased taxes for a needed service.

Only 52 percent of my 2005 water bills paid for water. No one has found a good way to measure sewage discharge, so 22 percent of my water charges is added on for sewer service. And then the Bloomington-Normal Water Reclamation District took another 27 percent of the actual water cost. And finally there was a $1.15 monthly service fee plus a city utility tax.

For that $304 worth of water, I paid $586.

But my real estate tax rate wasn't increased.

I would bet the same scenario is happening in Normal - and other towns, too.

After I figured up the add-on fees for water, I checked my other utility bills (I'm a glutton for punishment).

I now understand why a lot of younger people are switching to cell phones and getting rid of their "land lines" at home.

Cell phones are generally more expensive, but there are plans that allow free long-distance calls. And am I glad.

Last month, I didn't have a single long-distance call on my telephone bill. Thank goodness. The bill was $36.66. Oh, my residential line bill was only $15.99 - a reasonable sum. But there were those little government fees again: federal excise tax, state sales tax, Illinois telecom excise tax, state infrastructure maintenance fee, Illinois universal service fee; Simplified Municipal Telecom tax, Emergency 911 (at least I know where that money is going, I think), Illinois Telecom Relay service and a Federal Universal fee.

Then it was on to my cable television bill. Not so many taxes there - just an FCC regulatory fee, a city tax of $1.19 a month and a monthly franchise fee. But they still tacked about $3.50 onto my monthly fee.

By the time I got to my electric bill, I wasn't shocked.

My monthly bills weren't too bad. But there was the $18.90 a month facilities charge (dummy me, I thought that would be a cost of doing business, not a monthly add-on); a city tax, a franchise tax that probably goes to the city, too; a state tax, an "Illinois Utility Tax"; and an Illinois Commerce Commission Regulatory Tax, a fancy name for more state taxes.

The least amount I paid was $29.34 in extra fees on my electric bill each month.

I wasn't a happy camper by the time I added up the basic monthly charge, environmental recovery charge, city and state taxes on my natural gas bill. I paid more than $10 per month for those add-on fees and charges.

And there you have it folks. Our governments at work. I sometimes get the feeling that bureaucrats spend much of their time dreaming up new fees so they can avoid being honest with people and saying, "We have to increase your taxes."

Friday, April 21, 2006

C'mon, You Can Give A Little More

Alright, April 15th has come and gone, but you still can do a little something extra to help out. There is actually an obscure provision in the federal tax code which entices taxpayers to pay a little extra to Uncle Sam: the ability to write a special check to help pay down U.S. debt.

Yes, that's right, you CAN voluntarily send debt-reduction checks to the IRS along with your federal tax return, or just send in a check any ole time. It's not very well publicized by the IRS. There's no line on the 1040 form for "debt reduction." However, the IRS website offers instructions for those who don't feel they pay their "fair share":

If you want, make a check payable to “Bureau of the Public Debt.” You can send it to:

Bureau of the Public Debt, Department G, P.O. Box 2188, Parkersburg, WV 26106-2188.

Or you can enclose the check with your income tax return when you file.

According to the most recent IRS Data Book, last year 48 taxpayers mailed in contributions to reduce the public debt, for a total of exactly $21,179. That's $441 per gift. Since 1982, there have been a total of 16,122 voluntary contributions to reduce the debt, for a grand total of $9.8 million—or about 0.00012 percent of the nation's public debt of $8,367,661,575,868 as of March 29, 2006 according to the U.S. Treasury.

(Info courtesy of The Tax Foundation)

Thursday, April 20, 2006

Letters From:American City & County Magazine

Blogs, Transparency, and GovernmentsWe hope that Woodford County officials and office-holders are watching.

Over the past 15 years, technologies such as e-mail, instant messages and Web sites have created new ways for people and organizations to communicate. Now, blogs are maturing into a communication method that local governments can no longer ignore.Blogs, or Web logs, began as personal online journals. However, a growing population now is using blogs as information and news portals. Bloggers often are highly aware of local, regional and national news, and often focus on local government.

Some people have argued that blogs do not qualify as a legitimate media form and, therefore, bloggers should not enjoy the rights of traditional media organizations. However, municipalities should consider their state laws before making that argument. North Carolina, for example, has general statutes that explicitly define what qualifies as public information, and anything falling into that category is open for any individual — with or without press credentials — to examine. By cooperating with bloggers, local governments can find effective allies, educate residents and increase transparency within their organizations.

Besides acknowledging blogs in the community, local governments need to decide whether to host blogs of their own. Elected officials can use blogs to explain, in their own terms, why they voted a particular way on a controversial subject, rather than have their comments filtered through the mass media. Also, city leaders can use blogs to address the rising cost of fuel and the projected budget shortfall it will create, allowing readers to understand balancing municipal funds.

Free! Freee! Freeee!

In a blatent attempt (and keeping with our theme of "transparency) to generate more traffic here and increase our "hit count" - let the give-a-ways begin!

WoodfordTaxFacts.com will ship you a copy of Katherine DeBrecht's book, shown above - FREE (in the continental U.S.).

The book retails for $15.95, and can be had at Amazon for $9.99. I guess our deal is better. You can view it here.

We only have two, so the first and second email we receive requesting the book will get them. Go to "View My Complete Profile" on the top right of this page, then choose "email" on the left.

Look for more Freebies in the future; and it's not even coming out of your taxes! Is this a great country, or what?

UPDATE: The free books are GONE! Make sure to look for future promotions.

Why Edgar Didn't Run

A good new friend of ours was recently having breakfast out in Phoenix and lo and behold at the next table was our ole friend former Governor Jim Edgar. They discovered that they live quite near one another out there.

One thing led to another, and our friend ask the Governor why he didn't feel he could run for the Republican nomination. Governor Edgar reportedly said, "Well if I were there, I couldn't be here, could I?"

In light of Blago's residency quirks, maybe a Governor living in Phoenix wouldn't be so bad.

Wednesday, April 19, 2006

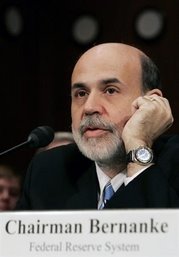

Bernanke's Off The List

From Reuters -

Wed Apr 19, 3:48 PM ET WASHINGTON -

Federal Reserve Chairman Ben Bernanke said tax cuts can spur greater economic activity and boost economic efficiency, but generally do not wholly pay for themselves."Tax cuts that reduce marginal tax rates will likely improve the efficiency of the economy and boost overall economic activity," Bernanke said in an April 18 letter to Rep. Brad Sherman (news, bio, voting record).

"Because they increase economic activity, cuts in marginal tax rates typically lead to revenue losses that are smaller than implied by so-called static analyses, which hold economic activity constant," he said. "However, under normal conditions, tax cuts do not wholly pay for themselves."

The letter, released by Sherman's office on Wednesday, was in response to written questions the California Democrat submitted in connection with a February 15 hearing on monetary policy at which Bernanke testified.

So that's it. In addition to his cheesy watch, Chairman Bernanke's prounouncement that "tax cuts do not wholly pay for themselves" (who ever said they were supposed to be revenue neutral) precludes his inclusion in our Christmas list.

The Primary Is Officially Over

Arguably, the two most interesting items came up nearly as asides, right towards the very end of the meeting. There was a delicate minuet performed around the issue of the "Public Safety" sales tax of 1% with regard to the general financial situation of the county after an audit for 2005 which showed that the 44% property tax levy increase probably wasn't all that wise or necessary. Fuel tax receipts (surprise, surprise) are way up as well. We shall report on the audit as soon as we get a copy from the courthouse.

The other item was discussion about potential pay raises for County Board members; yep, election definitely over.

Monday, April 17, 2006

News Flash: Wal-Mart NOT Opening Banks

The retailing giant is seeking FDIC approval to operate as an industrial bank. Which means instead of having to utilize a third-party financial institution to process a customer's check, debit or charge card payment, Wal-Mart can perform these transaction themselves. Just as Target, GE, Toyota, and General Motors do.

The banks currently performing these transactions for Wal-Mart currently charge the retailer millions of dollars each year for this work. Wal-Mart is simply asking for the same privilege its chief competitor Target enjoys.

So rest easy, Wal-Mart will NOT be "destroying the banking business as we know it".

Sunday, April 16, 2006

Why Do You Look For The Living Amongst The Dead?

howsoever, we wish all a blessed Easter season, the power of God's grace and healing to be manifest in your lives, and for forgiveness to wrap around our hearts and minds.